By Julian Crump, President of the International Federation of Intellectual Property Attorneys (FICPI)

There's a myth that protecting intellectual property (IP) is the preserve of larger firms and is unsuited to smaller and medium-sized enterprises (SMEs).

While large companies invest in IP for good reasons – to protect their products and services, discourage competition and create new revenue streams for themselves – IP undoubtedly benefits smaller businesses too.

SMEs that apply for patents, trademarks or designs are more likely to grow quickly and succeed than those that do not.

In fact, the evidence is that SMEs that apply for patents, trademarks or designs are more likely to grow quickly and succeed than those that do not.

A 2019 EPO/EUIPO study demonstrated that SMEs that have at least one IP right are 21 percent more likely to experience a growth period. Meanwhile, a 2021 update to the study found that fewer than 9 percent of SMEs owned at least one of the three main IP rights (a patent, trademark and design). By contrast, the figure is close to 60 percent for larger firms. This reveals a shocking disparity in the use of such a valuable business tool.

The value SMEs gain from protecting their IP assets comes in many forms

As well as serving as the current president of FICPI, I am a Chartered UK and European Patent Attorney, and a partner in the firm of Abel + Imray in London, Bath and Cardiff, UK and Spain. To look for examples of SMEs that use IP protection as a key element of their business success, my partners and I reviewed our list of clients. We did not have to look far.

The results are instructive and hugely encouraging for other SMEs:

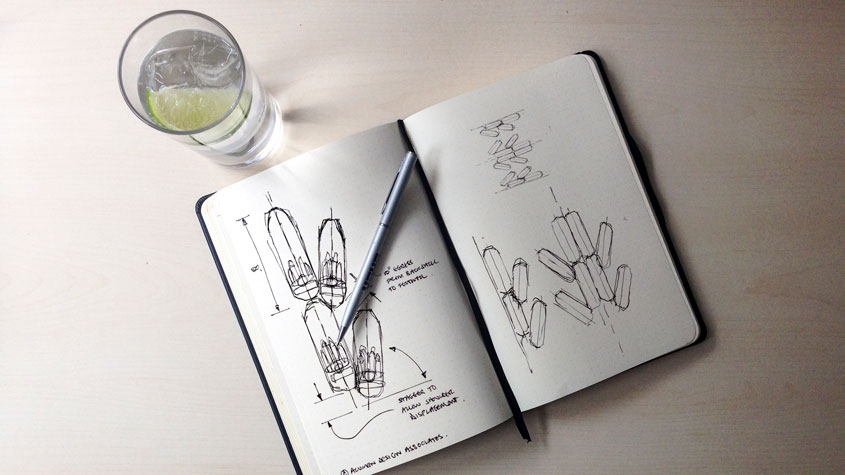

- Growing license sales and royalty revenue - Several years ago, market-leading aircraft seating designers Acumen Design Associates, led by founder Ian Dryburgh, moved from a consultancy model, with revenue based on project fees, to also creating their own designs, which are then patented. Today, a major part of Acumen’s revenue comes from issuing licenses for the use of their protected designs - including a large deal in 2016 with United Airlines for business class seating.

- Winning venture capital (VC) funding - XYZ Reality Ltd., has won numerous accolades for a highly accurate, “engineering grade” augmented reality (AR) solution which ensures building construction matches exactly the architects’ drawings. Their solution avoids problems with traditional site setting-out methods and penalties for errors. The patent application was complicated, involving multiple disciplines from advanced engineering to AR and physics. A positive opinion on the application from the European Patent Office (EPO) helped XYZ Reality secure venture capital (VC) funding.

Over and above the underlying product or service it protects, IP is a valuable asset in its own right. Indeed, it can become a company's most valuable asset.

- Making SMEs more valuable for acquisition - Siltbuster Limited is recognized as the UK’s top provider of on-site water treatments and is a winner of the Queen’s Award for Enterprise. A big factor in its success has been the patenting of breakthroughs by the company’s founder, Dr Richard Coulton, who began with a vision of treating concrete wastewater at construction sites in a more environmentally friendly way. In 2018, the technology caught the eye of Workdry International, which ended up purchasing Siltbuster – and its IP.

- From university research to university spin-out - A research project at University College London investigating how to transfect cells using siRNA morphed into a small company, NanoGenics Limited. A few years – and several research cycles – later, NanoGenics developed LipTide® to target selected genes and better combat cancer. The company sold the associated IP rights for GBP 4.5 million (approx. USD 6.2 million), helping their cutting-edge medical development advance to commercialization.

- Using trade secrets to stay under competitor radar - Today, Rheon Labs Ltd., which makes protective body wear for high-impact sports, is a strategic and sophisticated user of IP. Initially, they relied on trade secrets to protect selected aspects of their IP, staying under their competitors’ radars (rather than filing patent applications, which are automatically published after 18 months). However, once others started encroaching on their field, Rheon Labs pivoted to patenting. This put their technology into the public domain, but in return they gained 20 years of exclusivity and their competitors must now devise their own new and inventive products if they wish to secure their own patents.

- Trademarks to underpin commercial partnerships - The Rheon Labs® trademark was registered early, when pre-filing searches indicated there were few third-party rights that might prevent its use. As the company grew and moved into the realm of collaborations and commercial partnerships, water-tight non-disclosure agreements (NDAs) and design registrations were added to its IP estate. Rheon Labs® now has strong brand recognition, and the company benefits from valuable goodwill in its name. Registration serves to lock in that value, provides a visible sign of ownership, and facilitates co-branding with partners like Xenith LLC, a top American football helmet manufacturer, whose products now carry the Rheon Labs® trademark, and are recognized for reducing concussive impacts and associated brain injuries, alongside their own. Without registration and water-tight licensing arrangements, allowing a third party to apply your trademark to their goods would put you at risk of losing it. Registration typically protects a company’s marks for 10 years, but with the advantage that they can be renewed in perpetuity – as long as they don’t become generic terms.

- Creating valuable IP assets to demonstrate market potential - Ceres Power is a company with patented "deep technology" that has a wide range of clean energy applications and has become a hugely valuable asset. However, had commercialization specialists, IP Group Plc, not stepped in at a critical moment, the company would likely have declared bankruptcy following the failure of initial field trials. IP Group works with early-stage companies that own IP originating from university research to get them to a point where they can demonstrate the real-world viability of their technology to attract co-investment from large corporates and ultimately acquisition. IP Group's Dr. Rob Trezona told me, "IP is a table stake. If our portfolio companies haven't secured their IP rights, they won't be able to raise finance. And typically, investors are looking for a number of patents rather than one or two." Key to IP Group’s successful turnaround of Ceres was the realization that its world-class IP position would allow it to generate more value as a technology provider that jointly develops and licenses technology than as a vertically integrated manufacturing business. The company has partnered successfully with Bosch, Doosan and Weichai Power to develop products for data centers, distributed generation and heavy road vehicles, and is able to generate value for itself through license fees and royalties.

These examples illustrate how, over and above the underlying product or service it protects, IP is a valuable asset in its own right. Indeed, it can become a company's most valuable asset. Without doubt, there will be countless other examples among the clients of other IP firms worldwide.

IP rights create a protective wrapper around an intangible asset – locking in value and making it tradeable, through licensing, pooling, securitization or acquisition. Without IPRs, investments made by companies in developing new products and processes, or even in simply devising new product ideas, are at risk. It's a bit like creating a beautiful garden without putting up a fence to keep the rabbits out!

Without the help of a specialist IP attorney, an SME is unlikely to be able to identify the important points of novelty or broad utility of their inventions, which are vital for a successful IP strategy, or may simply be defeated by the registration process.

Indeed, for SMEs, tackling IP protection can seem impossible. Seeking to obtain patent, trademark and design rights is complex. There are relatively few "self-filers", and of those few, the majority abandon their applications or are unsuccessful in gaining granted rights.

As a patent attorney, I obviously have a self-interest in pointing out the depth and sophistication of the services offered by independent IP professionals to SMEs.

IP rights create a protective wrapper around an intangible asset – locking in value and making it tradeable through licensing, pooling, securitization or acquisition.

However, given the stakes, the clear evidence that SMEs holding IP rights prosper relative to others that do not, and the all-too-frequent failure of SMEs to complete the application process on their own, the conclusion is clear.

SMEs should look to protect their IP assets to support and accelerate their growth by locking in the value of their IP and building intangible assets which can be used to underpin a wide variety of different business models, with innovation at their core.

Independent IP attorneys bring wide experience from advising a broad range of different clients. They can look beyond the immediate applications of an invention to focus on its points of novelty, giving the patents a longer useful life as the businesses they protect flex and adapt to new markets and are made more attractive to investors.

The investment an SME makes in partnering with an independent IP professional has a significant return, not only in terms of a successful application, but also for its future as the owner of IP rights.

No comments:

Post a Comment